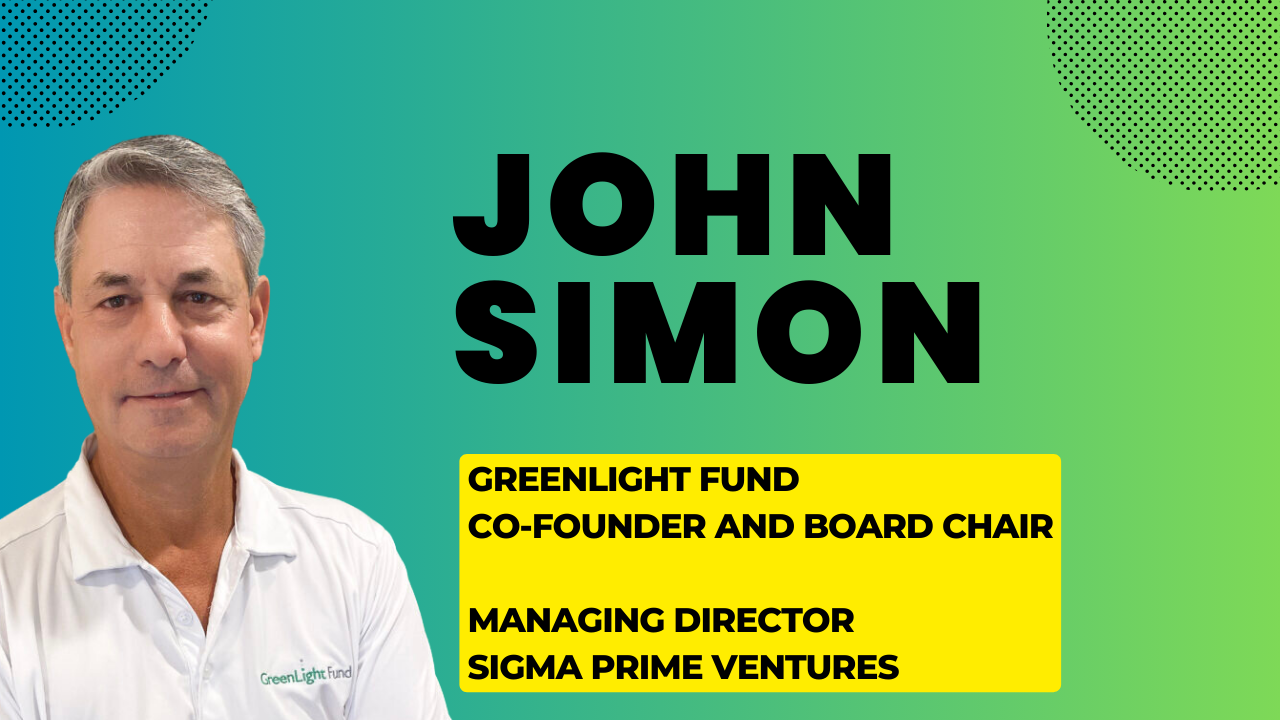

Episode #313 of The VentureFizz Podcast features John Simon, Co-Founder & Board Chair of the GreenLight Fund and Managing Director of Sigma Prime Ventures.

Thanksgiving is not only a special holiday because of the time with your family, all the great food, and of course, football, but it is also a time when lots of people volunteer and give back.

Thus, the timing of this interview with John couldn’t have been more perfect as we head into the Thanksgiving holiday.

Most people know of John as an entrepreneur and investor, as he was the founder of a company that went public and was a co-founder of General Catalyst and has since been with Sigma Prime.

But what many people might not know is the philanthropic side of his background.

John is the co-founder of the GreenLight Fund, a national nonprofit network matching local communities’ unmet needs with evidence-based social innovations. The organization takes a unique approach which is similar to how a VC firm operates where each city that it supports raises its own fund and decides on what strategic investments will have the greatest impact.

In this episode of our podcast, we cover:

- Advice for founders on how to incorporate a social mission into their company or a culture of giving back.

- John's background story and how he started his career in venture capital in the earlier days of the industry.

- Starting and scaling UroMed Corporation to an IPO.

- The story of how General Catalyst got started and his experience as a Venture Capitalist at Sigma Prime Ventures.

- What led John and his co-founder, Margaret Hall, down the path of starting the GreenLight Fund, plus how their model works and the impact it has had on various cities.

- Advice for entrepreneurs on how to build a company of lasting value.

- Why he has focused on investing in founders who are uniquely qualified and have world-leading domain experience to solve problems.

- And so much more.